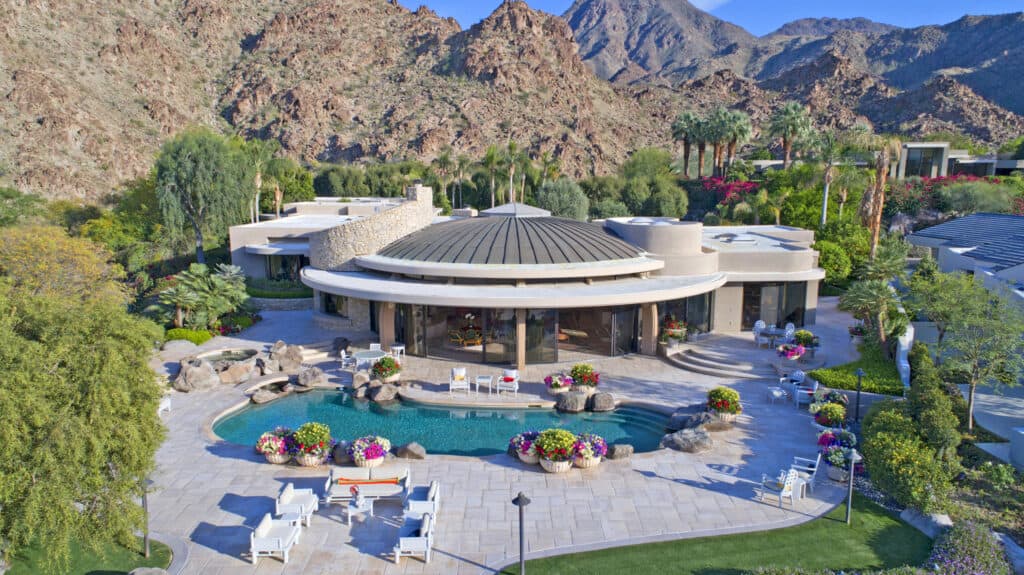

Easy income $$$$ 3 month rental pays a years of expenses

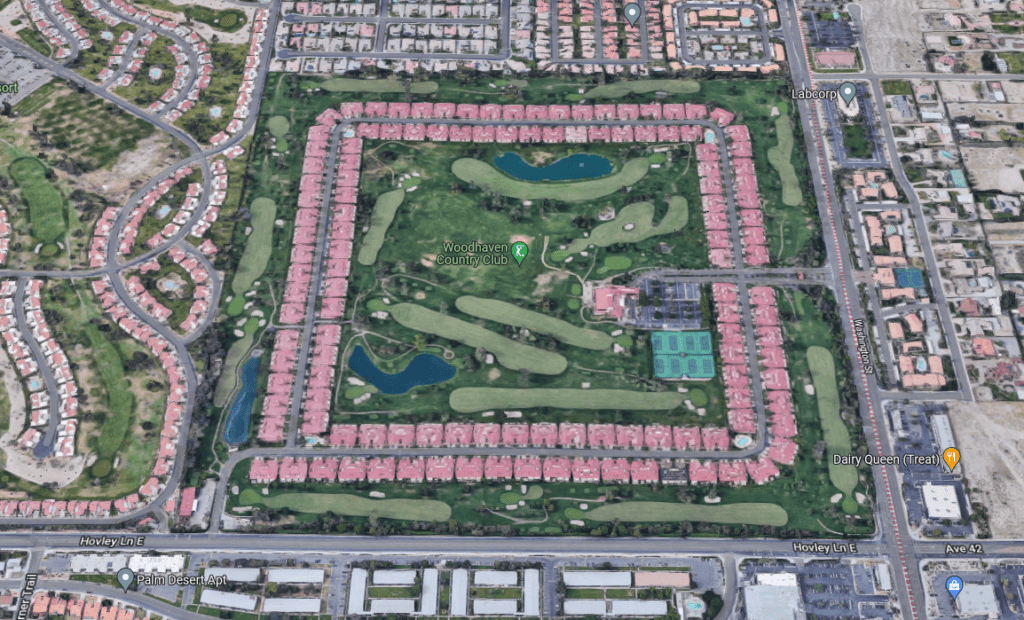

Investing in a vacation rental property. It can be a great way to generate income and enjoy your own vacation home. However, there are many factors to consider before you buy a vacation rental property, such as location, market demand, expenses, taxes, and management. I’ve searched the web for some helpful resources that can guide […]

Easy income $$$$ 3 month rental pays a years of expenses Read More »