The aging population is a significant demographic trend that has far-reaching implications for various sectors, including real estate. In this article, we delve into the impact of an aging population on the Palm Desert real estate market. As the number of seniors grows, how does it affect housing supply, demand, and property values? Let’s explore.

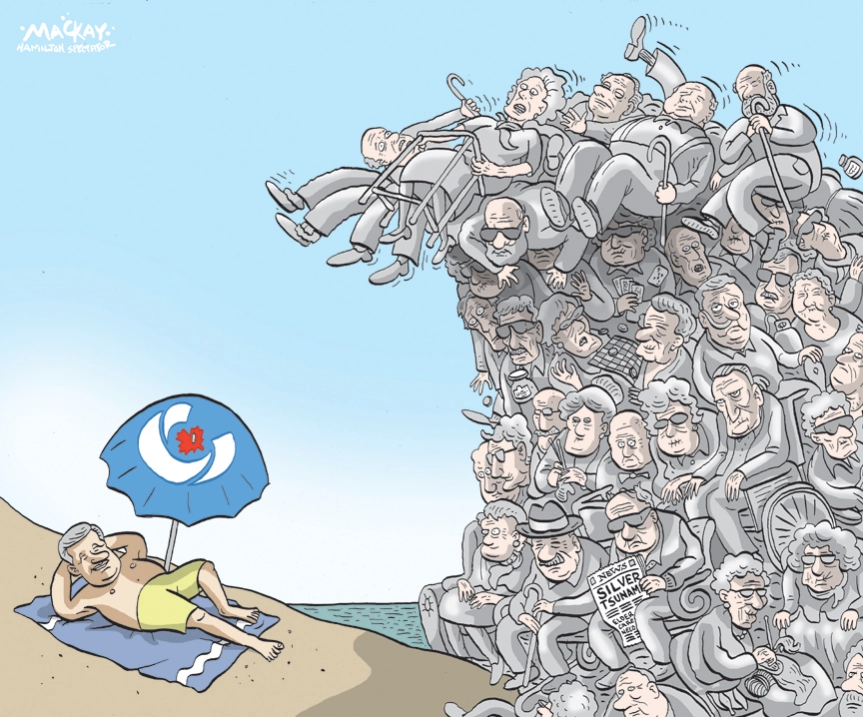

The Silver Tsunami: A Demographic Shift:

As of 2018, 52 million people in the United States were aged 65 and older. By 2034, this population is expected to, for the first time in American history, outnumber the 18-and-under population. This rising number of seniors will have a major impact on the real estate market.

Supply and Demand Dynamics.

1. Housing Supply from Aging Homeowners:

A significant portion of existing homes for sale over the next decade will come from the aging and mortality of baby boomer homeowners. However, research indicates that this influx of homes is unlikely to disrupt the housing market significantly. The Mortgage Bankers Association’s (MBA) Research Institute for Housing America (RIHA) found that sustained demand from population growth and younger generation households will keep home price reduction and excess housing supply at a minimum. Even as baby boomers are expected to provide 4.4 million homes annually in the coming years, the impact on home prices is projected to be minimal .

2. No Measurable Decline in Home Prices:

According to the MBA RIHA report, aging and mortality are gradual and predictable. Based on changing demographics and population growth, there is enough homebuyer demand to meet most of the existing inventory that will come onto the market from older homeowners. The study suggests that housing supply from baby boomers will lead to an excess of around a quarter-million units annually through 2032, with most of the adjustment to the excess inventory coming from a reduction in housing starts and completions. The rental market will also play a role in absorbing some of the supply.

Opportunities for Investors:

While the impact of aging on the real estate market is not insignificant, it will unfold over several decades. Savvy investors can take advantage of this demographic shift by considering the following:

- Senior Living Communities: As the aging population seeks housing options tailored to their needs, investing in senior living communities can be lucrative. Assisted living facilities, retirement communities, and age-restricted housing developments are areas to explore.

- Adaptation and Renovation: Older homeowners may choose to downsize or modify their homes to accommodate changing health needs. Investors can tap into this demand by offering renovation services or purchasing properties for adaptive reuse.

- Multigenerational Housing: With more seniors living longer, multigenerational housing arrangements are on the rise. Investors can explore opportunities to create housing solutions that cater to extended families.

Conclusion

The impact of an aging population on the Palm Desert real estate market is multifaceted. While supply dynamics will shift gradually, investors who understand the changing landscape can position themselves strategically. As the silver wave continues, the real estate industry must adapt to meet the evolving needs of seniors while maintaining a balanced market for all generations.